The year 2020 will forever be marked as a historic moment in global economics. Amid the outbreak of the global pandemic, the United States’ economic policy underwent dramatic shifts. Central to these changes was an unprecedented increase in the US money supply, primarily through an action colloquially referred to as “money printing.” However, the implications of this surge in money supply on global wealth are more nuanced and complex than some perspectives might suggest.

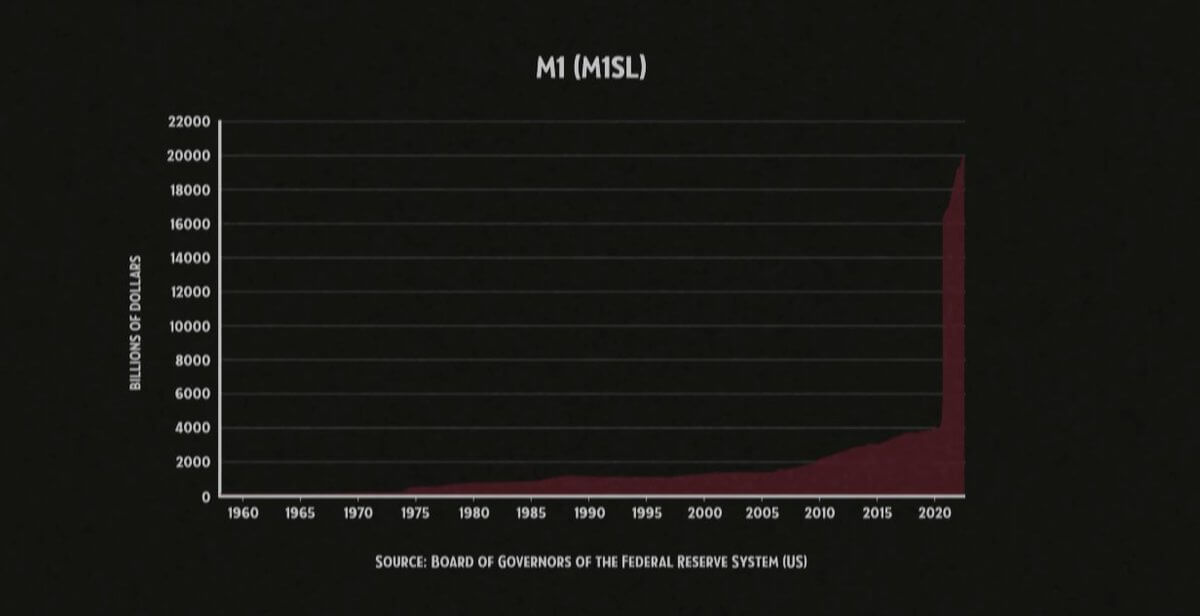

In March 2020, the US Federal Reserve embarked on a massive quantitative easing (QE) program, purchasing billions of dollars worth of government bonds and other financial assets to increase the money supply and encourage lending and investment. As the Federal Reserve’s M1 Money Stock statistics reveal, the money supply spiked dramatically, marking a clear departure from the moderate growth trend of previous years.

This large-scale expansion of the US money supply had ripple effects that extended far beyond America’s borders, given the central role the US dollar plays in global markets. However, to claim that the United States “robbed” the entire planet of 80% of its wealth in 2020 is an oversimplification of a complex situation.

Firstly, it’s important to understand that increasing the money supply does not directly translate to wealth generation or theft. When the Federal Reserve injects more money into the economy, it doesn’t necessarily create or take away wealth. Instead, it can decrease the purchasing power of money, potentially leading to inflation.

Moreover, the newly minted money was largely used to stabilize the US economy, prevent financial market collapse, and support millions of Americans who were financially struggling due to the pandemic-induced crisis. Without this economic stabilizer, the economic downturn could have been much more severe, not just in the US but globally.

The role of the US dollar as the world’s reserve currency also adds another layer of complexity. A significant increase in the dollar supply could potentially dilute the value of dollar-denominated assets globally, leading to a kind of ‘wealth erosion.’ However, due to the widespread economic uncertainty during 2020, the US dollar remained strong as investors sought safe haven assets, even as the money supply increased.

Nevertheless, the surge in money supply did raise concerns among economists about potential long-term effects, such as future inflation and the destabilization of the global financial system. Such a large-scale increase in the money supply is an economic experiment on a scale we’ve not seen before, and the long-term outcomes are uncertain.

In conclusion, while it’s true that the US significantly increased its money supply in 2020, interpreting this as a theft of global wealth simplifies the complex mechanisms of global finance and monetary policy. We still await the final verdict on the consequences of this bold experiment. For now, economists, policymakers, and observers alike continue to keep a close eye on the world’s largest economy and its ripple effects around the globe.

Further reading: